Changes to our KPIs in 2023

Our metrics are reviewed annually and updated as appropriate to ensure they remain an effective measure of delivery against our objectives. For 2023, the review of these metrics resulted in the following changes:

Following adoption of IFRSs 17 and 9, the Group no longer uses combined operating ratio to measure underwriting profitability and has, instead, adopted net insurance margin as it more closely resembles how the Group runs the business.

KPIs that have been impacted by the Group's adoption of IFRSs 17 and 9 have been restated for 2022. Earlier periods have not been recalculated and have not been reported. Comparative numbers will in due course be built back up to disclose five years of data.

In previous years the Group used earnings per share as one of its KPIs. As LTIP awards granted by the Group during 2023 included an operating earnings per share performance measure the KPI was updated to reflect the relationship to remuneration. Net promoter score continues to be a key measure of performance and is disclosed on page 53 of the Annual Report.

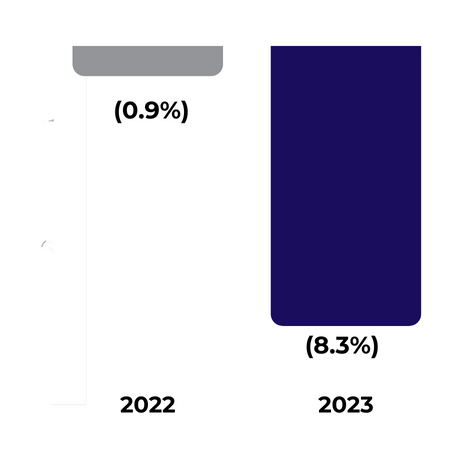

Net insurance margin - ongoing operations1 ("NIM") (%)

Definition

A measure of financial year underwriting profitability. A positive NIM indicates profitable underwriting. The NIM is calculated by dividing the net insurance service result by net insurance revenue.

Aim

We aim to produce a profitable insurance service result and the Group has an ambition over time to generate a NIM of above 10%, normalised for weather.

For additional performance information see page 28 of the Annual Report

Remuneration

We base part of the Annual Incentive Plan (“AIP”) awards on operating profit. The NIM is closely linked to this.

For additional performance information see pages 132 and 140 of the Annual Report

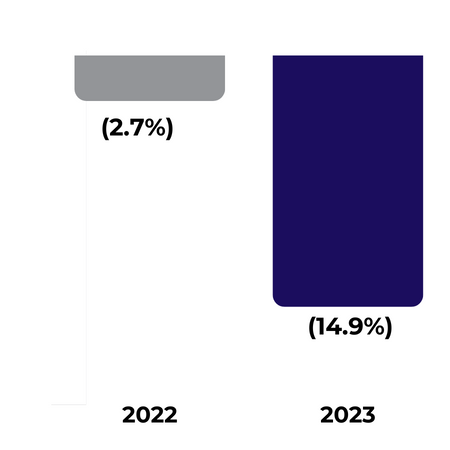

Operating return on tangible equity ("Operating RoTE")1 (%)

Definition

The return generated on the capital that shareholders have in the business. This is calculated by dividing adjusted operating earnings by average tangible equity.

Aim

We do not set a target. However our aim is to grow operating RoTE.

For additional performance information see page 31 of the Annual Report

Remuneration

We base the LTIP awards partly on adjusted RoTE over a three-year performance period.

For additional performance information see pages 132 and 143 of the Annual Report

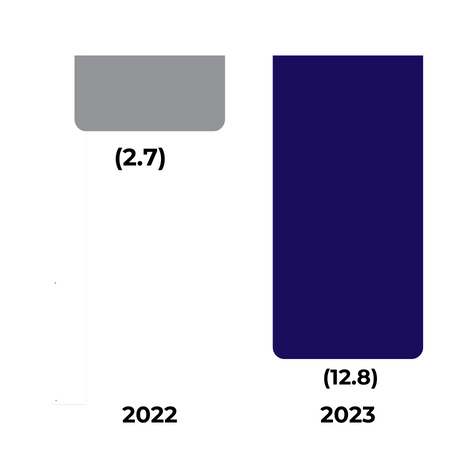

Operating loss per share - ongoing operations1 (pence)

Definition

This is calculated by dividing the earnings attributable to shareholders less coupon payments in respect of Tier 1 notes and restructuring and one-off costs by the weighted average number of Ordinary Shares in issue.

Aim

We have not set a target. However, our aim is to grow operating earnings per share.

For additional performance information see page 31 of the Annual Report

Remuneration

We based the 2023 Long-term Incentive Plan ("LTIP") partly on operating earnings per share.

For additional performance information see page 143 of the Annual Report

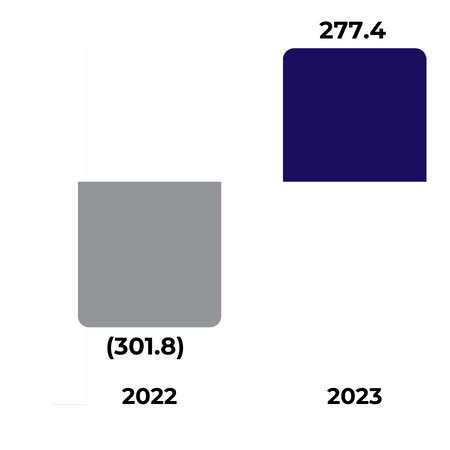

(Loss)/profit before tax (£m)

Definition

A measure of overall profitability of the Group, including the insurance service result, investment return, net insurance finance result and other operating income, expenses and finance costs.

Aim

Profit before tax includes income and expenses that are outside of management control, although it does aim to operate profitably.

For additional performance information see page 27 of the Annual Report

Remuneration

We base part of the AIP awards on operating profit. Profit before tax is closely linked to this.

For additional performance information see pages 132 and 140 of the Annual Report

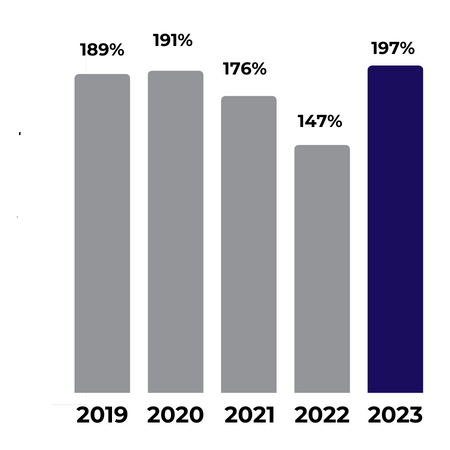

Solvency capital ratio1,2,3 (%)

Definition

A risk-based measure expressing the level of capital resources held as a percentage of the level of capital that is required under Solvency II.

Aim

Under normal circumstances, the Group aims to maintain a solvency capital ratio around the middle of the risk appetite range of 140% to 180%.

For additional performance information see page 32 of the Annual Report

Remuneration

Solvency capital ratio within our risk appetite is an indicator of capital strength, which is one of the gateways for the AIP awards and an underpin for LTIP awards.

For additional performance information see pages 132 of the Annual Report

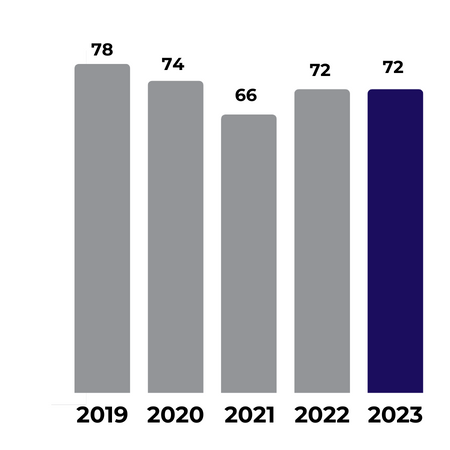

Colleague engagement4 (%)

Definition

Engagement is the degree in which our colleagues use their cognitive, emotional, and behavioural energies to help the Group achieve our company goals. We partner with Viva Glint to regularly monitor engagement levels across the Group.

Aim

To make the Group best for our customers and best for our colleagues. We gauge employee engagement through our colleague opinion surveys and we aim for high colleague engagement scores each year.

Remuneration

The AIP awards include a weighting to a balance of employee metrics, including engagement.

For additional performance information see pages 132 and 141 of the Annual Report

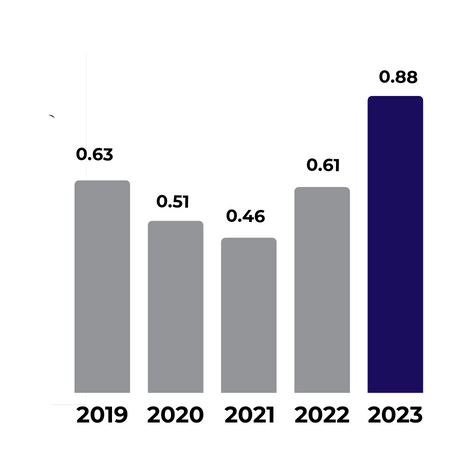

Customer complaints5 (%)

Definition

The number of complaints we received during the year as a proportion of the average number of in-force policies.

Aim

This measure indicates where our customer service has not met expectations to the extent that the customer has initiated a complaint. We aim to improve this over time.

Remuneration

The AIP awards include a weighting to a balance of customer metrics, including complaints.

For additional performance information see pages 132 and 141 of the Annual Report

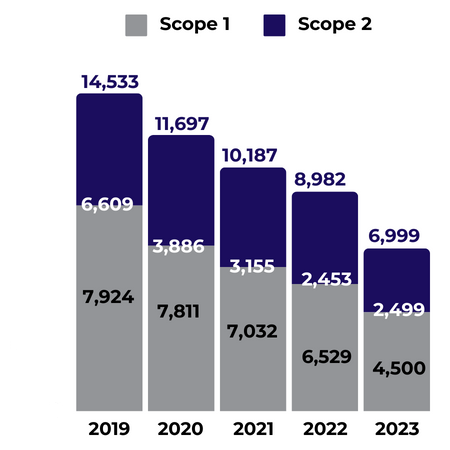

Operational emissions1 (tCO2e)

Definition

Operational emissions are defined as the Scope 1 and 2 emissions across our buildings and accident repair centres.

Aim

We aim to reduce Scope 1 and 2 emissions by 46% by 2030 from a 2019 base year.

For additional performance information see page 62 and 64 of the Annual Report

Remuneration

From 2022, the LTIP awards have an emissions performance condition which includes a targeted reduction in emissions and temperature score.

For additional performance information see pages 143 of the Annual Report

Notes:

1. See glossary on pages 261 to 264 of the Annual Report and Appendix A – Alternative performance measures on pages 265 to 266 of the Annual Report for reconciliation to financial statement line items.

2. The 2019 solvency capital ratio has been adjusted to remove the cancelled 14.4p final dividend and £120 million of the share buyback as announced in March/April 2020. (The reported number was a solvency capital ratio of 165%).

3. Estimates based on the Group’s Solvency II partial internal model.

4. The methodology for determining colleague engagement changed in 2022 as a result of a change of survey provider. Engagement scores for the years 2018 to 2021 are presented on a consistent basis. The 2022 score was assessed against a benchmark score of 75% and is not directly comparable to the scores in 2021 and prior years.

5. For the Group’s principal underwriter, U K Insurance Limited.